Small business invoice software sets the stage for modern financial management, allowing companies to streamline their billing processes with efficiency and accuracy. As manual invoicing becomes a relic of the past, these software solutions emerge as vital tools for small businesses looking to enhance their operations. With features designed to automate and simplify invoicing, businesses can not only save time but also ensure their financial records are precise and professional.

In this discussion, we’ll delve into the key features that distinguish effective invoice software, explore the significant benefits it offers, and provide insights into how small businesses can choose and implement the right solution for their needs.

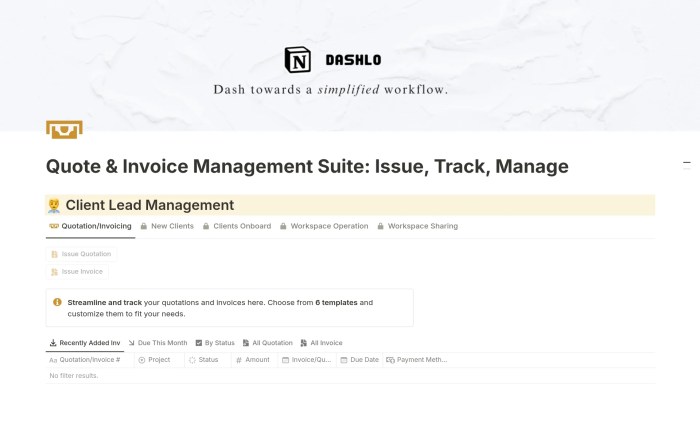

Overview of Small Business Invoice Software

Small business invoice software serves as a pivotal tool for managing financial transactions efficiently. Designed to streamline the invoicing process, it helps businesses maintain accurate records, improve cash flow, and enhance overall financial management. With the right software, small businesses can save time, reduce errors, and foster better relationships with clients by providing clear and professional billing.The primary features of small business invoice software set it apart from traditional invoicing methods.

These features typically include automated invoice generation, customizable templates, payment tracking, and integration with accounting systems. Such capabilities not only simplify the invoicing workflow but also provide valuable insights into financial health through reporting and analytics. By using invoice software, businesses can automate recurring billing and send reminders to clients, which further enhances efficiency and ensures timely payments.

Main Features of Invoice Software

Utilizing small business invoice software presents several advantages that traditional methods cannot offer.

- Automated Invoicing: Automatically generate invoices based on predefined templates and client information, reducing the manual effort involved.

- Payment Tracking: Keep track of outstanding payments and overdue invoices, allowing for prompt follow-ups with clients.

- Reporting and Analytics: Access detailed financial reports that help in decision-making and forecasting future cash flow.

- Multi-Currency Support: Cater to international clients by processing transactions in different currencies, enhancing global business opportunities.

- Integration Capabilities: Seamlessly connect with accounting software and other business tools to maintain cohesive financial records.

Small businesses that opt not to use invoice software often face significant challenges that can hinder their growth. Manual invoicing can lead to errors, delayed payments, and an inability to track financial health effectively.

“Without proper invoicing solutions, small businesses risk cash flow issues and may struggle to maintain accurate financial records.”

Some common challenges faced by these businesses include:

- Time-Consuming Processes: Manually creating and sending invoices can be labor-intensive, diverting time away from core business activities.

- Increased Risk of Errors: Human error in calculations or data entry can lead to discrepancies that may upset clients and complicate finances.

- Poor Cash Flow Management: Difficulty in tracking payments can result in late payments or missed invoices, affecting the overall financial stability.

- Lack of Professionalism: Handwritten or poorly formatted invoices can damage a business’s image and discourage potential clients.

Key Features of Effective Invoice Software

Effective invoice software can significantly streamline small business operations by simplifying the billing process and improving cash flow management. When selecting an invoicing solution, it is essential to focus on features that not only meet current needs but also accommodate future growth. This discussion highlights key features that small businesses should consider when choosing effective invoice software.

Essential Features of Invoice Software

When evaluating invoice software options, it is critical to understand the features that enhance usability, efficiency, and financial management. The following features are essential for small businesses:

- Customizable Invoice Templates: The ability to create branded invoices helps maintain a professional appearance and ensures consistency in communication with clients.

- Automated Billing: Automation reduces manual data entry, which minimizes errors and saves time. Regular invoices can be scheduled to go out automatically, ensuring consistent cash flow.

- Multi-Currency and Tax Support: For businesses operating globally, supporting various currencies and tax regulations is crucial. This feature allows businesses to cater to international clients effortlessly.

- Payment Gateway Integration: Direct integration with payment processors facilitates quicker payments, helping to maintain healthy cash flow by reducing the time between invoice issuance and payment receipt.

- Real-Time Reporting and Analytics: Comprehensive insights into outstanding invoices and cash flow trends empower business owners to make informed financial decisions.

Benefits of Automation Features

Automation plays a vital role in enhancing the efficiency of small business operations. By automating repetitive tasks, invoice software allows businesses to focus on core activities rather than administrative work. Key benefits of automation include:

- Time Savings: Automation reduces the time spent on creating and sending invoices, allowing employees to focus on growth-oriented activities.

- Improved Accuracy: Automated calculations minimize human error, ensuring that invoices are accurate and reducing disputes with clients.

- Enhanced Cash Flow Management: Automated reminders for overdue invoices help businesses maintain steady cash flow by prompting timely payments from clients.

- Streamlined Customer Relationships: Consistent communication through automated follow-ups fosters stronger relationships and encourages prompt responses.

User-Friendly Interfaces of Popular Invoice Software

A user-friendly interface is crucial for ensuring that all team members can effectively utilize the software. Popular invoice software options are designed with intuitive interfaces that simplify navigation and functionality. Notable examples include:

- FreshBooks: Known for its clean interface, FreshBooks makes it easy for users to create invoices, track expenses, and manage clients without a steep learning curve.

- Invoice Ninja: Offering a simple layout with drag-and-drop features, Invoice Ninja allows users to customize invoices and manage client information effortlessly.

- Square Invoices: Square’s platform is designed with small businesses in mind, featuring straightforward navigation and a seamless payment integration process.

- Zoho Invoice: This software provides a comprehensive dashboard that displays key metrics and tasks, making it easy for users to keep track of invoicing activities at a glance.

As small businesses navigate their invoicing needs, focusing on these key features will enable them to improve efficiency, reduce errors, and enhance cash flow management.

Benefits of Using Invoice Software for Small Businesses

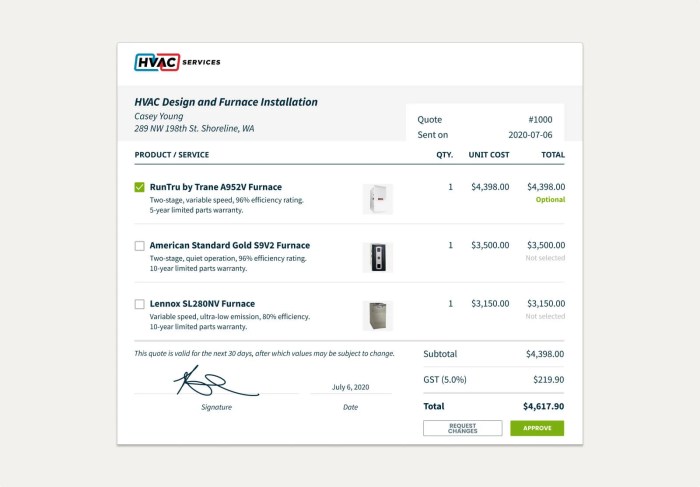

Source: invoiceit.com

Managing invoices can often feel like a daunting task for small business owners. However, using invoice software is a game-changer that streamlines the billing process, saving time, enhancing accuracy, and improving your business’s professional standing. Below, we explore the key benefits that come with implementing invoicing software into your operations.

Time-Saving Advantages

One of the greatest advantages of using invoice software is the significant amount of time it saves compared to manual invoicing processes. Traditional invoicing often requires hours spent on data entry, calculations, and error corrections. In contrast, invoice software automates many of these tasks, allowing you to generate invoices in just a few clicks. With features such as templates, recurring billing, and automated reminders, you can spend less time on administrative tasks and more time focusing on growing your business.

For instance, a small business that previously took an hour to create and send invoices can now accomplish the same task in just a few minutes with software.

Improved Accuracy and Reduced Errors

Accuracy in billing is crucial for maintaining trust with your clients and ensuring timely payments. Invoice software significantly reduces the likelihood of human errors that can occur during manual entry. By automating calculations and minimizing manual input, the software ensures that invoices are error-free. A study revealed that businesses using invoicing software reported a reduction in billing errors by up to 70%.

This not only enhances the reliability of your billing process but also leads to quicker payments, as clients are less likely to dispute accurate invoices.

“Accuracy in invoicing builds trust and fosters long-lasting client relationships.”

Enhanced Professional Image and Customer Relationships

Utilizing invoice software allows small businesses to present a polished and professional front to their clients. Customizable templates can reflect your brand identity, making your invoices not only functional but also visually appealing. This professionalism extends to customer interactions as well. Many invoice software solutions allow for personalized messages and follow-ups, creating a more engaging experience for clients. A well-structured invoice can convey your attention to detail and commitment to excellent service, which can lead to improved customer satisfaction and loyalty.

For example, a small graphic design firm that utilizes branded invoice templates and follows up with clients about their invoices can significantly improve their customer retention rates, as clients appreciate the thoughtfulness and professionalism displayed.

Choosing the Right Invoice Software

Selecting the appropriate invoice software is crucial for the efficiency and growth of any small business. With numerous options available, it’s essential to evaluate each software solution based on specific needs and future scalability. The right invoicing tool not only streamlines billing but also adapts alongside business growth.

Checklist for Evaluating Invoice Software

When considering invoice software options, a comprehensive checklist can be a valuable tool. It helps ensure that all critical aspects are covered, which can lead to better decision-making. Here are key factors to evaluate:

- User-Friendliness: The software should have an intuitive interface that allows for easy navigation and reduces the learning curve for staff.

- Integration Capabilities: Check if the software integrates seamlessly with other tools such as accounting software, payment gateways, and CRM systems.

- Customization Options: Look for the ability to customize invoices to reflect your brand with logos, color schemes, and personalized messages.

- Scalability: Ensure the software can accommodate business growth, including features for handling increased transactions and new services.

- Mobile Access: Consider if the software offers mobile functionality for invoicing on the go.

- Security Features: Assess the security measures in place to protect sensitive financial data.

- Cost Structure: Evaluate if the pricing model (subscription, one-time fee, or per transaction) aligns with your budget and business model.

Considerations for Scalability and Adaptability

As businesses evolve, their invoicing needs change as well. Choosing software that can scale with your business is vital. Look for solutions that offer tiered pricing plans, allowing you to upgrade as your transaction volume increases. Additionally, ensure that the software can adapt to new billing requirements or changes in your service offerings without extensive manual adjustments. For instance, a small business that starts with a basic invoicing process might expand to include recurring billing or multi-currency transactions as they grow.

Software that accommodates these features prevents the need for a complete system overhaul down the line.

Importance of Customer Support and Resources

Reliable customer support is an essential factor when selecting invoice software. Efficient and accessible customer service can significantly reduce downtime and frustration during implementation and beyond. Look for vendors that provide:

- 24/7 Support: Availability of support staff to assist with urgent issues at any time.

- Comprehensive Documentation: Resources such as user manuals, FAQs, and tutorial videos that can help users troubleshoot independently.

- Community Forums: Engagement with other users can provide additional insights and solutions to common problems.

- Regular Updates: Find a vendor committed to continuously improving their software based on user feedback and technology changes.

Choosing the right invoice software not only streamlines billing processes but also positions your business for scalable growth and enhanced customer satisfaction.

Implementing Invoice Software in a Small Business

Transitioning from manual invoicing to software-based solutions can significantly enhance efficiency and accuracy in a small business. The process requires careful planning and execution to ensure a smooth transition and continued productivity. This section Artikels important steps to successfully implement invoice software, including training staff and integrating the software with existing systems.

Steps for Transitioning to Software-Based Invoicing

The steps involved in moving from manual invoicing to software solutions are crucial for effective implementation. Here are essential actions to consider during this transition:

- Assess Current Invoicing Process: Evaluate the existing manual processes to identify pain points and areas for improvement.

- Choose the Right Software: Research and select software that meets the specific needs of your business, focusing on features such as usability and integration capabilities.

- Migrate Data: Carefully transfer existing customer and invoicing data into the new system, ensuring accuracy and completeness.

- Test the Software: Before full implementation, conduct testing to identify any issues and familiarize staff with the software.

- Go Live: Launch the software and start using it for all new invoices, while monitoring the transition closely for any unforeseen challenges.

Training Methods for Staff on New Invoice Software

Training is a critical aspect of implementing new software effectively. It’s important that all staff members are comfortable and proficient in using the invoice software. Here are several training methods that can be effective:

- Hands-On Workshops: Organize interactive sessions where employees can practice using the software in real-time scenarios.

- Online Tutorials: Provide access to video tutorials that allow staff to learn at their own pace, covering key features and functions.

- User Manuals: Distribute comprehensive user guides that detail step-by-step instructions for common tasks within the software.

- One-on-One Training: Offer personalized sessions for employees who may need additional help or have specific questions regarding the software.

Best Practices for Integrating Invoice Software with Existing Accounting Systems

Integrating invoice software with current accounting systems is essential for streamlining financial operations. An effective integration process ensures that data flows smoothly between systems, reducing the chances of errors. Here are best practices for successful integration:

- Evaluate Compatibility: Ensure the new invoice software is compatible with existing accounting systems before implementation.

- Set Clear Integration Goals: Define specific objectives for integration, such as reducing manual data entry or improving report accuracy.

- Involve IT Personnel: Engage your IT team early in the process to address any technical challenges that may arise during integration.

- Regularly Update Both Systems: Keep both the invoice software and accounting systems updated to ensure compatibility and security.

- Monitor Data Flow: After integration, regularly review data flow between systems to quickly identify and rectify any discrepancies.

Comparison of Popular Invoice Software Options

When it comes to selecting the right invoice software for small businesses, there are numerous options available, each with its unique features, pricing structures, and user experiences. Understanding the differences among these tools can help business owners make informed decisions that will enhance their invoicing processes, improve cash flow, and ultimately support growth.In this section, we will provide a comprehensive comparison of some of the most popular invoice software options, including key features and user feedback.

This will include a table that summarizes essential aspects such as pricing, features, and overall user satisfaction, as well as a discussion on niche solutions tailored for specific industries.

Feature Comparison Table, Small business invoice software

To facilitate a clear understanding of what various software solutions offer, the following table Artikels some of the key features, pricing, and user reviews for popular invoice software options:

| Software | Key Features | Pricing | User Reviews |

|---|---|---|---|

| FreshBooks | Time tracking, expense tracking, customizable invoices, client portal | Starting at $15/month | 4.5/5 (Excellent customer support) |

| QuickBooks Online | Comprehensive accounting, invoicing, reporting, payroll integration | Starting at $25/month | 4.3/5 (Great for accounting) |

| Zoho Invoice | Multi-currency support, recurring invoices, client portal | Free for up to 5 customers | 4.6/5 (User-friendly interface) |

| Wave | Free invoicing, receipt scanning, accounting features | Free | 4.4/5 (Ideal for freelancers) |

| Invoice Ninja | Custom invoice design, recurring billing, time tracking | Free for basic use; $10/month for pro features | 4.5/5 (Highly customizable) |

Pros and Cons of Leading Software Choices

Each software option comes with its strengths and weaknesses, often highlighted by user feedback. Below are some pros and cons based on real user experiences: FreshBooks

Pros

Excellent customer support, intuitive user interface, robust reporting features.

Cons

Some users find it costly as their business grows, limited integrations with other tools. QuickBooks Online

Pros

Comprehensive features catering to small to medium-sized businesses, strong accounting capabilities.

Cons

Can be overwhelming for new users, pricing can increase with add-ons. Zoho Invoice

Pros

Cost-effective for small businesses, offers a solid feature set for invoicing.

Cons

Limited accounting features compared to other Zoho products, may require additional integration for full functionality. Wave

Pros

Completely free for invoicing and accounting, user-friendly.

Cons

Limited customer support options, may not suit larger businesses needing advanced features. Invoice Ninja

Pros

Highly customizable, flexible pricing options.

Cons

Some advanced features only available in the paid version, user interface can be less intuitive.

Niche Software Solutions

In addition to the mainstream options, there are niche software solutions designed for specific industries or business types. These tools often provide tailored features that address unique invoicing needs.

Construction Industry

Software like CoConstruct specializes in project management and invoicing for contractors, featuring client billing, expense tracking, and project scheduling tools.

Freelancers and Creatives

AND CO offers simplified invoicing and expense tracking geared toward freelancers in creative fields, allowing for easy time tracking and proposal creation.

E-commerce

Shopify Invoicing integrates seamlessly with e-commerce platforms, providing unique features like automated invoicing based on customer purchases and sales tracking.Understanding the advantages and limitations of various invoice software can guide small business owners to find the solution that best fits their invoicing needs, industry requirements, and customer expectations.

Common Mistakes to Avoid with Invoice Software

Using invoice software can streamline processes and improve efficiency, but small businesses often stumble into common pitfalls that can undermine these benefits. Understanding these mistakes is crucial to ensure that the software is an asset rather than a hindrance. This section will highlight frequent errors made by small businesses, along with tips for securing data privacy and guidance on troubleshooting typical issues.

Frequent Pitfalls in Invoice Software Use

Many small businesses encounter specific mistakes when utilizing invoice software, which can lead to operational inefficiencies or even financial discrepancies. Here are some of the top missteps to watch out for:

- Neglecting Regular Updates: Failing to update the software can result in security vulnerabilities and a lack of new features that enhance usability.

- Improper Data Entry: Errors in client information or invoice details can lead to delays in payment and confusion. Double-checking entries is essential.

- Ignoring Integration Capabilities: Not utilizing integration with other business tools, such as accounting or CRM software, can lead to redundancy and wasted time.

- Overcomplicating Invoices: Creating overly detailed invoices can confuse clients. Simple, clear, and concise invoices are more effective.

Ensuring Data Security and Privacy

Protecting sensitive invoicing information is paramount. Implementing security measures helps safeguard both your business and your clients. Here are some best practices to enhance data security:

- Use Strong Passwords: Ensure that all users have unique, complex passwords that are changed regularly to minimize unauthorized access.

- Enable Two-Factor Authentication: Adding an extra layer of security makes it significantly harder for unauthorized users to access sensitive data.

- Regularly Backup Data: Frequent backups can protect your information against loss from hardware failure, ransomware, or other unforeseen issues.

- Limit User Access: Restrict access to invoice software to only those who need it, reducing the risk of accidental data modification or leaks.

Troubleshooting Common Issues

When issues arise with invoice software, knowing how to troubleshoot can save time and frustration. Below is a guide to handling common challenges:

- Software Crashes: If the software frequently crashes, check for updates or compatibility issues. Clearing cache or reinstalling can also resolve problems.

- Inaccurate Calculations: Review formulas and settings used in the software to ensure they are correctly configured, as incorrect settings can lead to erroneous billing.

- Client Payment Issues: If clients claim they haven’t received invoices, verify that emails are sent correctly and check spam filters to ensure they aren’t being blocked.

- Slow Performance: If the software is sluggish, consider upgrading hardware or optimizing network connections to improve speed and efficiency.

Future Trends in Invoice Software

Source: notion.so

The landscape of small business invoice software is evolving rapidly, influenced by advancements in technology and changing business practices. Emerging technologies are set to redefine how invoices are created, managed, and processed. Understanding these trends can help small businesses stay ahead in a competitive environment.With the integration of new technologies, small business invoice software is experiencing significant transformations. One of the most impactful changes is the incorporation of artificial intelligence (AI) and machine learning (ML), which streamline processes and enhance accuracy.

By utilizing AI, invoice software can automatically categorize expenses, predict cash flow, and even flag discrepancies, drastically reducing the time and effort spent on manual entry and reconciliation.

Artificial Intelligence and Machine Learning in Invoice Management

AI and ML are revolutionizing invoice management by introducing automation and predictive capabilities. This integration allows for improved accuracy and efficiency in invoicing processes. Businesses can expect the following benefits:

- Automated Data Entry: AI can extract data from invoices and populate fields automatically, minimizing human error and saving time.

- Intelligent Analytics: Machine learning algorithms analyze past invoice data to identify patterns, enabling better forecasting and budgeting.

- Fraud Detection: Advanced algorithms can monitor transactions in real-time to detect potential fraud, protecting small businesses from financial losses.

In addition, AI-driven chatbots can assist in customer service, answering inquiries about invoices and payment statuses, which enhances client relationships and satisfaction.

Impact of Remote Work and Digital Transformation on Invoicing Needs

The shift towards remote work and the ongoing digital transformation are reshaping invoicing requirements for small businesses. As more companies adopt flexible work arrangements, the demand for accessible, cloud-based invoice solutions is increasing. Key aspects of this trend include:

- Cloud-Based Solutions: Businesses are increasingly favoring cloud technologies that allow employees to access invoice software from anywhere, facilitating remote work.

- Integration with Other Tools: As companies utilize various software for project management and accounting, invoice solutions that seamlessly integrate with these platforms will become essential.

- Enhanced Security Features: With data breaches on the rise, businesses will prioritize invoice software that offers robust security measures to protect sensitive financial information.

The demand for real-time collaboration tools will also increase as teams work together across different locations, making it necessary for invoice software to support shared access and communication.

“AI and machine learning are not just trends; they are the future of efficient invoice management, paving the way for smarter decisions and enhanced business performance.”

End of Discussion

Source: getjobber.com

In summary, adopting small business invoice software is a strategic move for any growing enterprise. Not only does it bring efficiency and accuracy to billing processes, but it also enhances the overall professional image of a business. As we look to the future, it’s clear that leveraging technology in invoicing will be essential for continued growth and success in a rapidly evolving marketplace.

FAQ Overview

What is small business invoice software?

It’s a digital tool designed to help small businesses create, manage, and send invoices efficiently.

How does invoice software improve cash flow?

By automating invoicing, it speeds up billing cycles and ensures timely payments, enhancing cash flow.

Can small business invoice software integrate with accounting systems?

Yes, many invoice software options offer integration capabilities with various accounting platforms.

Is invoice software user-friendly for non-tech-savvy individuals?

Most invoice software is designed with intuitive interfaces, making it accessible for users without technical expertise.

What security measures should I consider when using invoice software?

Look for software that offers data encryption, secure payment processing, and regular security updates to protect sensitive information.